Tuesday, January 31, 2006

Where are you going, Straits Times Index?

(1) Singapore will hold its general election soon. The government will paint a rosy picture as usual. (2) Local economy speeds up since 4Q last year. Government has lifted the GDP growth prediction. (3) Regional economy entities are doing well. Japan finished decade-long recession. China won't see retreat until Olympic year 2008.

But we must keep in mind that negative factors are not faded. These are: (1) High record crude oil price, which may reach us$100 per barrel. (2) US economy halts because of high interest rate. (3) Potential pandemic of bird flu.

What can you draw from above? I only know that in the next three month, the market mood is positive.

Disclaimer: This website doesn't recommend you buy anything.

Saturday, January 28, 2006

Year of the Dog

A year has passed. At the very beginning of brand new year, I wish I could overcome some problems in investing. One typical problem is that I could not hold the good stock for enough long time to enjoy the big price jump. I often feel hands itchy when it shows some paper profit and have the impulse to sell it.

Here I have some prescription to share with you.

(1) Leave the market for some period. Don't be so over-analyzed. (2) Do you find another more promising share? If not, better not sell current holdings. (3) Join some online forums to discuss with fellows.

Remember: Big profit comes from holding, not trading.

Disclaimer:This site is not an inducement of investment.

Thursday, January 26, 2006

Share Buyback exercise

If the company has a lot of cash reserve yet not find an investment opportunity, it may declare a special dividend. Or indirectly, it buys its share from open market. It means its shares are the best investment at that time. Through buyback, the floating number of shares decreases. So the earning per share would go up, making its share more attractive. For example, local banks such as OCBC and UOB are both in such share buyback exercise.

Sometimes a director might buy his company's share in open market. I.e. a director of Lasseters kept buying its shares during last several months. In this case, he signals to public that he is confident about the future of the company.

Last situation is actually not buy back. However, I like it most. It is an investment fund that keeps buying a company. If you check last year announcements about Eu Yan Sang, you would find that before its share price jumped, Aberdeen Asset Management Asia Ltd made lots of purchases. If someone notices such situation, do drop me an email.

Disclaim: This website is not an inducement of investment.

Monday, January 23, 2006

Brokers in SGX market

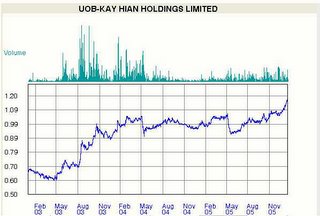

From SARS year 2003 to end of 2005, the share price of Singapore Exchange Ltd almost tripled to $3.10. But for the two main broker firms in SGX, Kim Eng and UOB-Kay Hian, their prices hover only a little bit above history. See the left picture. It is from SGX website.

With SGX posted a historical 2Q result (quarter ending 31/12/05), I guess stockbrokers should follow its steps. UOB-KH will post its financial year report soon. We can expect it will announce at least a final 7 cents dividend. So its price target of $1.25 is almost guaranteed.

Kim Eng has announced a "dividend policy" last Nov. when it issued 3Q result. It wrote: The Directors believe that through several years of solid earnings and prudent strategic management of its assets, the Company has been able to fortify its balance sheet so that it can sustain all current business activities, comfortably manage a significant upturn in such business activities while having the flexibility to pursue expansion should the right strategic opportunities arise.

It is so optimistic. A generous dividend is almost seen.

Sunday, January 22, 2006

More Facts about Adsense

Google puts ads on your site, and share the ad income with you. That is where your money comes from. So Google must display the ads which are relevant to your site content. By this way, people who view your blog are also likely to click the ads. Google uses machine algorithm to determine what your blogs are talking about. Please note it is a machine. So the keywords in your content are very important. They help Adsense to choose ads. You can imagine some keywords likely to worth more.

Try to write different type of blog. If you are interested only in FOREX, only those ads about FOREX would get displayed. Frankly speaking, this kind of sites is not suitable for Adsense. Change your blog settings to archive each passage. So every blog will signal to Adsense to display different ads. New ads tend to give you more money because they find new opportunities in your site.

It is no wonder that a lot of people make money by writing books on Adsense. Simply by sharing their experience on Adsense, they earn much money.

Sunday, January 15, 2006

Exchange Traded Fund

Here in Singapore we have only one "Exchange Traded Fund" that tracks STI. The fund buys in STI component stocks in appropriate weight. It makes best effort to track the STI. In my opinion, it outperformed the STI since its incubation in 2002. For example, the STI on 13/01/06 was 2405 while the Net Value per unit of STI-ETF was $24.87.

The exchange traded fund has another pro than normal fund: its liquidity. It can be traded on any day that SGX opens for share trading. Normal fund will be redeemable only twice per month.

Saturday, January 7, 2006

Sense of Adsense

I found a truth: after I wrote a new post on my blog, the Adsense trended to accumulate more points to my Adsense account. I guess it is because that each new post causes Adsense to choose new ads to display on my page. The new ads usually worth more. By this mechanism, bloggers are encouraged to post more often.

Though it is enough good, I feel the Google Adsense is lacking presense to companies outside U.S. The ads almost come from U.S. companies. So they are less attractive to the users of Asian countries. The ads get less clicks.

Tuesday, January 3, 2006

Unit share market of SGX

Here I wish to tell you there is an online trading system provided by POEMS. You can place orders in unit-share market by yourself. And the minimal charge is only $10!

For those small investors who want to INVEST in blue chips instead of TRADE on blue chip warrants, this trading tool is the best one.

Last suggestion: don't trade those penny stocks on unit-share market. Those penny stocks lack enough liquidity. Yesterday I sold NeraTel at 42 cents, while it is trading at 48 cents on broad market.